It's open season as buyers are spoilt for choice

House buyers will have more choice when a rush of properties hits the Sydney market now that spring is blooming and the election, school holidays and the football grand finals are out of the way.

“August was definitely influenced by the election, September was somewhat influenced by the [school] holiday season at the end of the month, plus the football, but October … there’ll be a bit of a surge,” says the managing director of SQM Research, Louis Christopher.

The senior analyst with BIS Shrapnel, Angie Zigomanis, says the end to the football season makes a big difference. “Agents are happier to market properties when people are more available on weekends to go and check them out,” he says.

According to SQM Research, there were 17,468 houses on the market in Sydney last month. Christopher is expecting that to surge to 19,000 this month before peaking at more than 20,000 next month. That would be a rise of 14 per cent on October last year and 32 per cent on last November.

The director of LJ Hooker Mosman, Geoff Smith, is expecting to see more vendors this spring but plenty of buying and selling regardless. “I think that this year is going to be very different to last year and the year before,” he says. “There wasn’t a lot of confidence and there was probably a bit of an oversupply of stock, whereas now it’s probably more of a traditional market.”

But the anticipated flood of properties will give buyers more choice and Christopher is predicting it will also push auction clearance rates down, probably to the mid-50 per cent mark.

However,the general manager of the Fairfax-owned Australian Property Monitors, Anthony Ishac, expects the auction clearance rate to stick at about 60 per cent. “There’s going to be more stock, so it’s definitely going to have some impact,” he says. That would be less than the 70 per cent of last year’s first-home-buyer frenzy, more than the sub-50 per cent seen in GFC-affected 2008 but similar to 2007.

So will a burst of spring properties have a big effect on prices this year? A director of BresicWhitney, Shannan Whitney, doesn’t think so. “You really need to see a really serious amount of stock for that to have some sort of influence and I just don’t think that you’re going to see it this year,” he says.

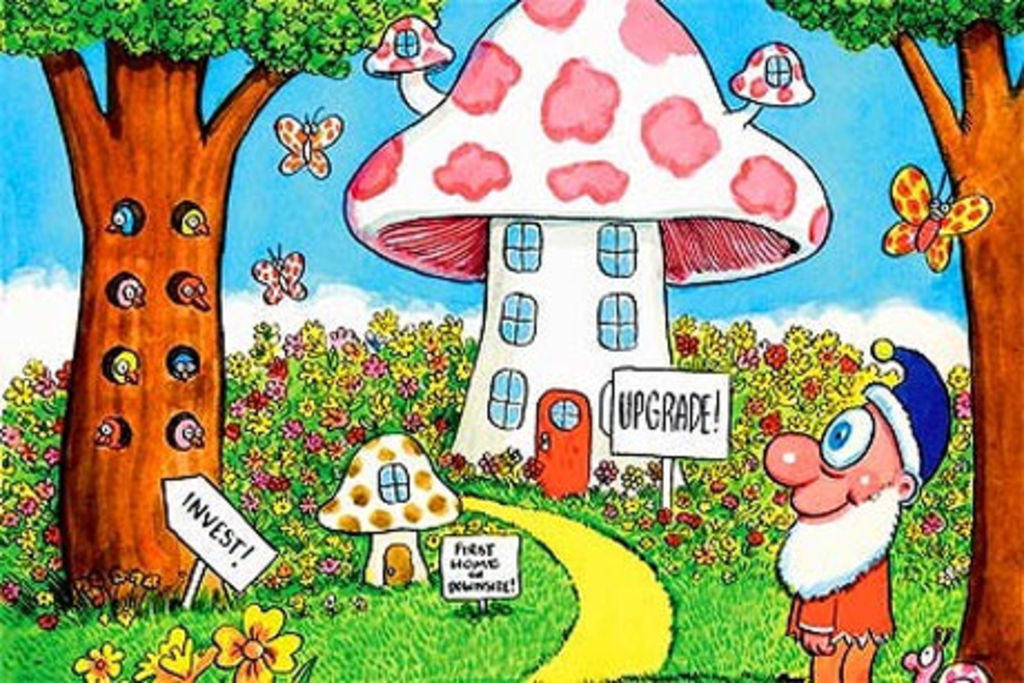

However, more houses could please upgraders who’ve faced a “lack of buying options”, says the general manager of Laing+Simmons, Leanne Pilkington.

Not all agents are predicting a surge. A director of Georges Ellis & Co at Strathfield, Joseph Georges, has about 10 per cent less stock for October than he was expecting. “Funnily enough, September was quite big; I thought October would be bigger,” he says.

Figures from RP Data-Rismark show Sydney house prices grew 0.2 per cent in August, bucking the decline of 0.2 per cent in capital city prices for the month. In the three months to the end of August, prices in Sydney fell 0.4 per cent.

Auction ‘indigestion’

The auction clearance rate for September was 65 per cent, which is a solid result but nowhere near the 70 per cent and 80 per cent reached earlier in the year. The chief economist at AMP Capital Investors, Shane Oliver, says the figures are not surprising given the market “is suffering a little bit of indigestion after the huge gains in prices that we have seen over the last year or 18 months”.

In September, the city, east and inner west had stronger clearance rates, making up for the fall across the south and northern beaches, Ishac says.

Bubble trouble?

There’s been talk as to whether Australia has a housing bubble. A recent report by investment bank Goldman Sachs says the Australian market isn’t in a speculative bubble but could be 35 per cent overvalued and at risk of deflating if the economy shifts dramatically. Fitch Ratings agency is also conducting a stress test of the market after repeated queries from investors.

However, most experts reject the notion the market is primed to pop. “There’s no housing bubble in Australia, if anything there’s an extremely flat market at the moment,” says the president of the Real Estate Institute of Australia, David Airey.

Oliver says he “just can’t see what’s going to cause [Australia’s very expensive market] to collapse” – as happened in Ireland, Spain, the US and to some extent Britain during the GFC. He reasons that unemployment is falling, population growth is strong, albeit slowing, and we’re heading into a resources boom.

Another factor underpinning the market is a lack of new houses, which the executive chairman of mortgage broker Aussie, John Symond, says is due to government inaction that is “nothing short of negligent” because it pushes prices up.

‘Dangerous territory’

Banks are loosening their lending criteria, post-GFC. “Banks did tighten probably too hard, where even people with a decent deposit were getting knocked back,” Symond says. Now “there’s responsible lending but banks are becoming more realistic and not looking for ways to say no”.

Australians spend 34.6 per cent of their income on their mortgages, according to the HIA-Commonwealth Bank Affordability Report. In NSW it is 38 per cent – about the same proportion when mortgages rates peaked at 17.5 per cent in the early 1990s.

Symond calls it “frightening”. Airey labels it “dangerous territory”. “Any further interest rate rises will put unsustainable pressure on … people who already have a mortgage who simply can’t escape,” he says.

A more comfortable level is about 30 per cent, which is where the Reserve Bank argues two-thirds of mortgaged households are actually at. When it reported on the economy last month, the Reserve Bank drew on data from the Household, Income and Labour Dynamics in Australia (HILDA) survey and noted “a well-established pattern of around half of all indebted owner-occupier households being ahead of their scheduled repayments, with most others tracking on schedule”.

There is broad expectation of up to five rate rises next year, taking the official cash rate to 5.75 per cent and the standard variable mortgage rate to about 8.55 per cent. Oliver says it’s hard to tell if that will put mortgage holders under serious stress but it could be a stretch too far if the standard variable mortgage rate, which is now about 7.3 per cent, were to hit 9 per cent. But then, he doesn’t think the Reserve Bank will go that far.

Christopher doesn’t believe the Sydney market could handle five rate rises. “You’d have a significant downturn, with price falls in a number of areas,” he says.

On the flipside, some buyers are banking on rises. Around Strathfield, Georges says he has seen buyers waiting on the sidelines hoping to swoop on a cheaper house.

The forecast

No one is expecting any fireworks when it comes to prices. Affordability is stretched and the dark clouds of rate rises are gathering.

BIS Shrapnel is forecasting about 5 per cent growth over the next 12 months – “nothing bad or nothing spectacular either”.

AMP’s prediction is “an average of 2 per cent to 3 per cent growth over the next six to 12 months”.

Christopher says by the time Christmas rolls around, Sydney house prices will have risen 5 per cent for the year, and 1 per cent to 2 per cent over spring.

The inner ring of Sydney, and particularly the lower north shore, could grow 7 per cent to 9 per cent, Christopher says.

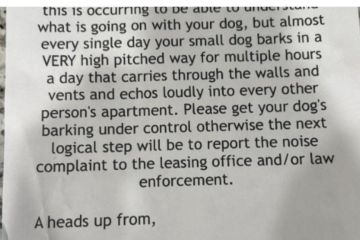

Satisfaction in paying her own mortgage

As soon as she saw her new house in Newtown, Natalie Wong knew she’d found the place she wanted to buy. The 25-year-old retail manager had been renting an apartment in neighbouring Camperdown but decided she would prefer to pay off her own house, rather than “somebody else’s mortgage”.

“When I walked in, I called my housemate and said: ‘I know where we’re going,”‘ she recalls.

Wong bought her two-bedroom, one bathroom Federation semi in the centre of Newtown late last month, paying $885,000 when it was auctioned through Joseph Tropiano of McGrath Estate Agents.

As a first home buyer, Wong was a little nervous about bidding, so asked her dad to step in — which had the added bonus of keeping her spending in check. In the end, Wong went $15,000 over her budget but is happy with the result. “It is an amazing place,” she says.

The renovated property on 145 square metres has six-metre ceilings. It has a north-easterly aspect, which has been beautifully utilised with high-set windows and glass doors at both the back and side of the property. These open to a slim passageway. “It is just drenched in sunlight,” Wong says of the house.

She will move into the property with her flatmate and says that having someone else live in the second bedroom will help with mortgage repayments. She’ll also be spending more time entertaining at home and visiting friends now that she has a mortgage to contend with.

First home buyers: missing in action

After the incentive-driven rush last year, first home buyers went quiet. RP Data’s July housing finance figures show first home buyer volumes remained about 30 per cent below their five-year average. However, the senior analyst with BIS Shrapnel, Angie Zigomanis, thinks demand has bottomed out and he expects first home buyers to re-emerge slowly.

The trickle could be starting. The executive chairman of mortgage broker Aussie, John Symond, says he has seen a 30 per cent increase in inquiries for loans from first home buyers during the past few months.

The chief executive of McGrath, John McGrath, says Sydney’s most active market is for houses less than $2 million, sought by families upgrading in the inner and middle rings. “As the sharemarket improves, so will the $2 million-$4 million bracket but this may take a little more time,” he says.

In some areas there is a shortage of suitable stock, in others there is a desire to upgrade — if only vendors could sell their properties first. The chief executive of Raine & Horne, Angus Raine, says: “We need an injection of cash into the market as there are a lot of people ready to move.” Raine & Horne Crows Nest reports it has more than three times the number of homes for sale in [the $900,000 to $2 million] price range than is usual for this time of year. “We need someone to shake the tree to get this market moving,” Raine says.

It’s a different story in the south, where Raine & Horne Sans Souci reports there aren’t enough houses to meet demand. In Bondi, Laing+ Simmons agents are seeing interest from young families for semis priced between $1 million and $1.2 million.

When first home buyers were circling, investors didn’t want to be part of the inflated market. Now the newbies have fled, investors are returning, Symond says.

At McGrath, investors now buy 35 per cent of the properties less than $1 million. Zigomanis thinks there’ll be more investors soon as rents grow and vacancy levels remain tight.

“Investor demand should pick up over the next 12 months,” he says.

The general manager of Laing+Simmons, Leanne Pilkington, says recent rises in house prices have reduced the rental yield for investors. However, Laing+Simmons is seeing investor interest in western Sydney, where for $500,000 they can pick up a “three- to four-bedroom single-storey house”.

Downsizers: packing their boxes, slowly

During the GFC, downsizers put their moving plans on hold. But McGrath is now seeing older people swapping bigger homes for inner-city apartments. “A good indicator for downsizer activity and strength is the $1 million to $3 million apartment market within five kilometres of the CBD,” McGrath says. “This market has improved over the past 12 months.”

The head of research at RP Data, Tim Lawless, thinks the “hump of baby boomers” deciding to sell the family home will boost downsizer activity as the year progresses.

In Mosman,Tim Foote says there is an eagerness to downsize but many are waiting to sell their house first. “They’re tied to the upper end housing market, which is I suppose the softer part of our market,” Foote says. However, prestige agent Ken Jacobs is upbeat. “There have been some reasonably strong sales which is now giving a bit more confidence to sellers,” he says.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More