Would another interest rate cut be disastrous for the property market?

A shock rise in the unemployment rate is increasing pressure on the Reserve Bank of Australia (RBA) to cut interest rates further in November, which economists warn could send already spiralling property prices higher again.

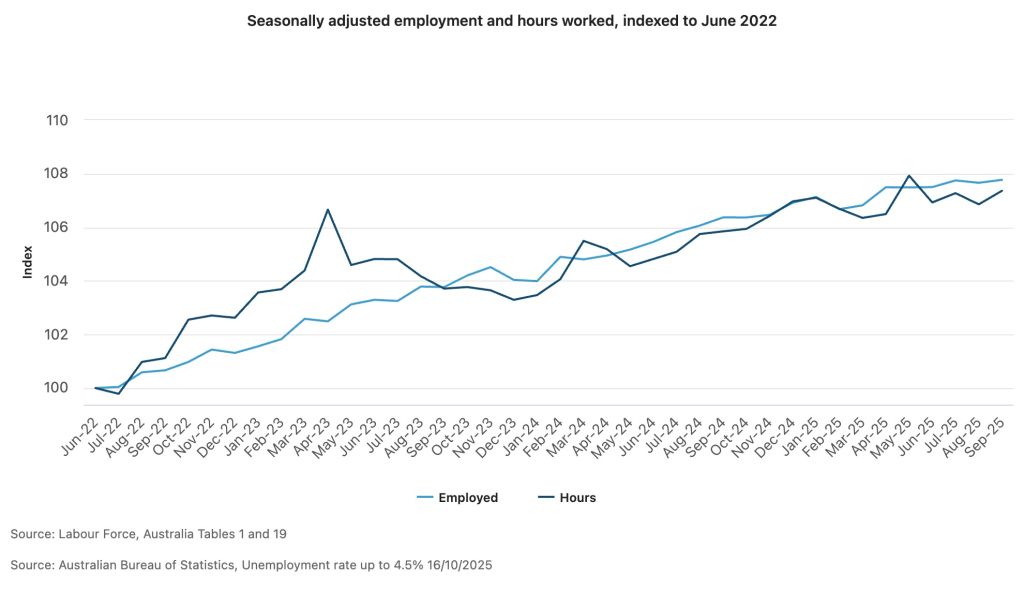

Unemployment jumped to a four-year high of 4.5 per cent in September, leaving 34,000 more people without jobs, Australian Bureau of Statistics (ABS) figures revealed on Thursday.

If that jobless figure is repeated in October, the RBA could find a fourth cash rate cut this year impossible to resist.

While likely a welcome move for home owners struggling with their mortgage repayments, the implications of another rate cut in an already rising property market could be grim, says Christian Nygaard, professor of housing economics at UNSW.

“I think the housing market is already supercharged, and any further reduction in interest rates would put additional pressure on prices,” Nygaard says. “That would make it even more difficult for first-home buyers and young Australians to get into the market.

“But these things are working in different directions. Higher unemployment will also mean more people will continue to be reliant on renting rather than being able to get a mortgage.”

In August, unemployment sat at 4.3 per cent, but it is now the highest seasonally adjusted jobless rate since November 2021. The ABS said the result was a combination of more men and women seeking work.

A new House Price Report from Domain released this week revealed that since the first of the three rate cuts this year in February, Australia’s house prices have risen at their fastest rate in four years, with Brisbane overtaking Melbourne as the nation’s second-most expensive city and Sydney prices hitting a jaw-dropping $1.75 million median.

All eight capitals posted another quarter of house price gains, with Sydney and Melbourne spearheading the turnaround in momentum.

Sydney house prices jumped by $58,148 (3.4 per cent) in just 90 days, the fastest quarterly growth in more than two years.

For the first time, Brisbane has become Australia’s second most expensive capital city. Brisbane is still reeling from its longest upswing in 21 years, with its 11th consecutive quarter of growth, and newly minted $1.1 million house price median.

In the 90 days between March and June, house prices in Melbourne jumped by $23,585, chalking the city’s highest median in three years and the sharpest quarterly lift in 3.5 years.

RBA Governor Michele Bullock recently described the labour market as “tight”. She predicted there’d be no significant job losses, forecasting the unemployment rate to hit 4.3 per cent by the end of the year.

But now many see the higher lift in the jobless figures as evidence that the economy is slowing and are calling for the cash rate to be cut to revive fortunes.

“Any reduction in interest rates will definitely capitalise property prices,” said Nygaard. “But it isn’t the role of the RBA to regulate prices; it sets interest rates independent of the movements in values in the housing market. There’s no simple lever to cut rates without an impact on prices.”

Peter Tulip, chief economist at the Centre for Independent Studies, says lower interest rates will put upward pressure on housing prices.

“They seem to be already recording growth as a result of the cuts made so far this year. That will continue,” he says.

“The prospect of a surge in prices, however, won’t persuade the RBA to put the rates on a pause because they’ve said that’s not the role of monetary policy; that’s the role of prudential regulations by APRA [The Australian Prudential Regulation Authority]. So, if there were excessive price rises, then the central bank would work in concert with APRA.”

That higher unemployment figure isn’t the biggest shadow on the horizon for the RBA, however. The next Consumer Price Index release, the inflation figure due out at the end of this month, will be much more important in any decision to cut or hold the cash rate.

If it’s higher than anticipated, the RBA will be more inclined to hold the current rate, especially as the jobless number can jump from month to month, says NAB market analyst Taylor Nugent.

In that case, the RBA might well decide to take no action until it has this month’s figure in hand, too, as well as that all-important inflation rate.

“Recent indicators of inflation were stronger than the RBA was expecting, mostly because of higher construction costs, rental prices and services prices,” Nugent says. “So, that has created some uncertainty that still needs to be resolved.

“Even with the lift in unemployment, there’s no real urgency to cut further, especially if there’s bad news coming on inflation. It is a balancing act, but we do think it’s less likely now that there will be a cut in November.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

- © 2025, CoStar Group Inc.