$200 million dollar mansions could become common. But how high can Australia's property market go?

There is truth to the adage that the rich are getting richer.

Property price records topple so regularly now that it’s easy to forget that 50 years ago, a mere $1.25 million sale would have turned heads.

The deal for the Boomerang estate in Sydney’s Elizabeth Bay in 1978 was Australia’s first seven-figure house sale, and it set the area’s real estate on a glittering trajectory. Boomerang made headlines again in 2023 when it changed hands for about $80 million.

But that’s only eight figures – now, nine-figure price tags are becoming more common. The new barrier to break is $200 million-plus, thanks to the listing of the mammoth harbourfront mansion Wingadal in Point Piper, Sydney, owned by home-loans businessman John Symond.

Adjusted for inflation, the original cost of Boomerang in today’s money is about $17.7 million. That would not even buy a bedroom in Wingadal.

Ray White chief economist Nerida Conisbee says there will come a time when $200 million deals will no longer be a surprise.

“We won’t see a high number of properties transact at that $200 million range, but given we have seen growth in people recording net wealth of a billion dollars, it starts to lead to more homes transacting at those really high price points,” Conisbee says.

High water marks

Bellevue Hill is the nation’s most expensive suburb, with a median of $9.625 million, according to the latest Domain House Price Report. In 2004, when Domain data began, that title belonged to Vaucluse, with a median of $2.6 million. Today, it is $7,322,500.

When Boomerang was sold in the ’70s, investments in mining and commercial property were producing a new upper class. Today, technology ventures and cryptocurrency are behind the latest breed of affluent buyers.

David Malouf, director of Highland Double Bay Malouf, sells to this cashed-up market. He can compare notes on prices with his father, esteemed agent Bill Malouf.

Case in point: In 2012, Bill sold a home on Olola Avenue in Vaucluse for $11 million. Recently, his son sold it again for circa-$45 million.

“I remember Bill was selling waterfront homes in Point Piper for $15 million to $20 million, which back then, had a wow factor,” Malouf says.

“Now, to get onto that strip, you are conservatively talking $80 million, $100 million, $200 million.”

Malouf says there are only about 330 waterfront houses in Sydney’s eastern suburbs – 110 with marina berths – and vendors can name their price.

Scarcity and money for improvements provide a springboard for stratospheric prices to continue. Late last year, Malouf sold a Vaucluse harbourside mansion that was due for a significant renovation for just under $55 million. Once finished, he believes this will test the $100 million mark.

However, the most elite properties are often passed down within families. Their prices would match Wingadal’s $200 million, but they probably won’t ever come to market, Malouf says.

“These properties are handed down from generation to generation,” he says. “It’s not a matter of price, it’s a matter of emotion – they’re just not for sale.”

Where to from here?

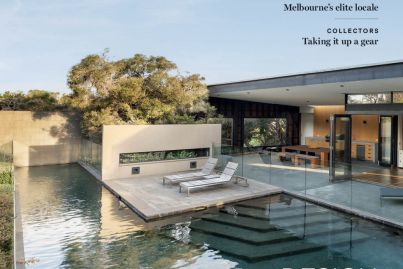

John Bongiorno, group sales director at Marshall White in Victoria, recalls the hubbub around Melbourne’s first $1 million sale.

The 1980 deal for 20 St George’s Road in Toorak was a revelatory moment for the then-teenage agent. A contemporary house at the address, which replaced the original, traded through Marshall White’s Marcus Chiminello in 2023 for $23 million.

It is difficult to predict precisely where prices will go, Bongiorno says, but global demand is significantly greater than supply.

“We have a lifestyle that is the envy of the world,” he says.

“The demand for something super special is becoming even greater, and I think that will continue over the next 50 years.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

- © 2025, CoStar Group Inc.